Investment results

The investment policy is based on an investment portfolio that distinguishes between fixed-income and return assets. The distribution at any point in time is aimed at having a good chance of achieving our ambition in the long term, a pension that is stable in value for retired members and non-contributory policyholders and a welfare pension for active members, without the risks becoming too great.

The fixed-income securities largely consist of relatively 'safe' investments, which significantly secure part of the future expected pension benefits. Think in particular of government bonds with a spread within and outside Europe. It also invests in slightly riskier fixed income securities, such as corporate bonds and emerging market bonds. The higher risk is compensated by a higher return expectation.

More about our Investment policy

Do you want to know more about the choices made by Philips Pensioenfonds in its investment policy?

Go to Investment policyThe investments with more risks are classified as real assets. The aim of these investments is to achieve a higher return than fixed-income securities. Think of investments in shares and real estate.

|

Amounts in millions of euros

|

End of Q4 2025 | End of Q3 2025 | End of Q2 2025 | End of Q1 2025 |

| Investment assets |

17,654 |

17,748 | 17,545 | 17,475 |

Due to the new pension system, the Board of Philips Pensioenfonds has considered what this change means for the Fund's policy. We will therefore be dealing with a new reality in the short term. The Fund's policy is normally long-term. However, due to the system change, there is reason to deviate from our long-term policy on a number of points. The aim of this is to give our participants a good start in the new pension system. Until the transition, the Fund applies an investment policy in which the risk profile has been reduced to prevent sharp falls in the funding ratio.

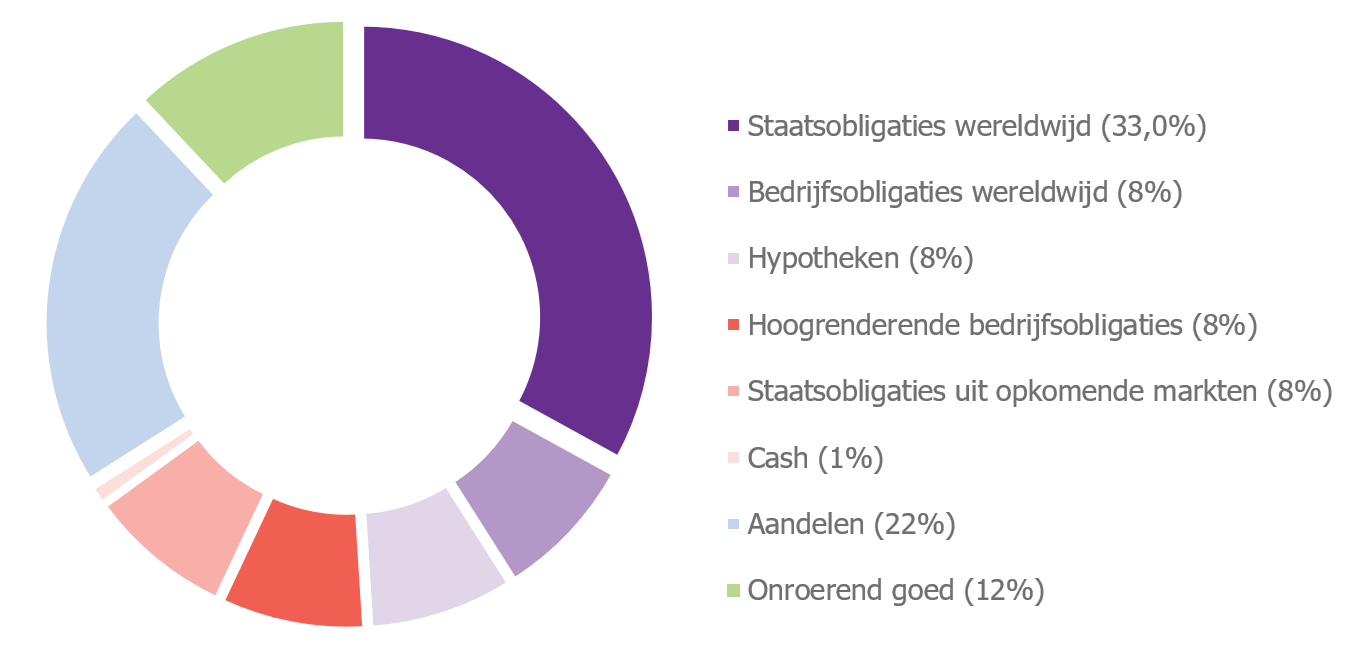

The distribution of the strategic investment portfolio is temporarily as follows: 66.0% of the assets are invested in fixed-income securities and 34.0% of the assets are invested in commercial securities. The chart below shows more details. Fixed-income asset classes are shown in purple and orange, while return assets are presented in blue and green.

Click here for more information about the investment policy of Philips Pensioenfonds.

The financial position of Philips Pensioenfonds is exposed to a number of risks. For example, movements in interest and inflation rates have a major impact on the pension fund’s ability to pay its future pensions (including indexation). That is why, besides investing in fixed-income and return assets, the pension fund also purchases additional ‘protection’ to hedge some of its exposure to this interest risk. That additional protection against interest-rate risk is not included in the benchmark. It is important to realise that the additional protection only covers part of the interest risk. Scenarios are possible where realising the ambition of an indexed pension is in jeopardy. Think of scenarios with disappointing stock returns, an interest rate that becomes even more negative or sharply rising inflation.

Philips Pensioenfonds assesses the investment results by comparing them with an objective benchmark.

The table below shows the following return figures:

- Total return without the aforementioned hedging against interest-rate risk. This percentage can be compared against the corresponding benchmark.

- Total return including hedging against interest-rate risk; no benchmark available.

|

Philips Pensioenfonds |

Benchmark |

|

|

|

Q4 2025 |

Q4 2025 |

| Total return (net of hedging for interest-rate risk) |

1.1% |

1.0% |

| Total return (including hedging for interest-rate risk) |

0.2% |

does not apply |

The total return of the portfolio (including interest rate risk hedging) was 0.2% in the fourth quarter of 2025. The increase in interest rates had a negative impact on the return of the fixed income portfolio, resulting in only a slightly positive return for this part of the portfolio. The equity portfolio also achieved a positive return in the fourth quarter. Overall, this resulted in a slightly positive total investment return for the quarter.

Comparison with benchmark

The total return (excluding interest rate risk hedging) was nearly equal to that of the benchmark in the fourth quarter.

Related information

Is the information below interesting for you?

Indexation policy

We try to increase your pension every year. This is called 'indexation'. But indexation cannot be taken for granted. Do you want to know more about our indexation policy?

Go to indexation policy

Responsible investments

Responsible investment means selecting investments with due observance of the environment, social issues and good corporate governance.

Go to Responsible investment