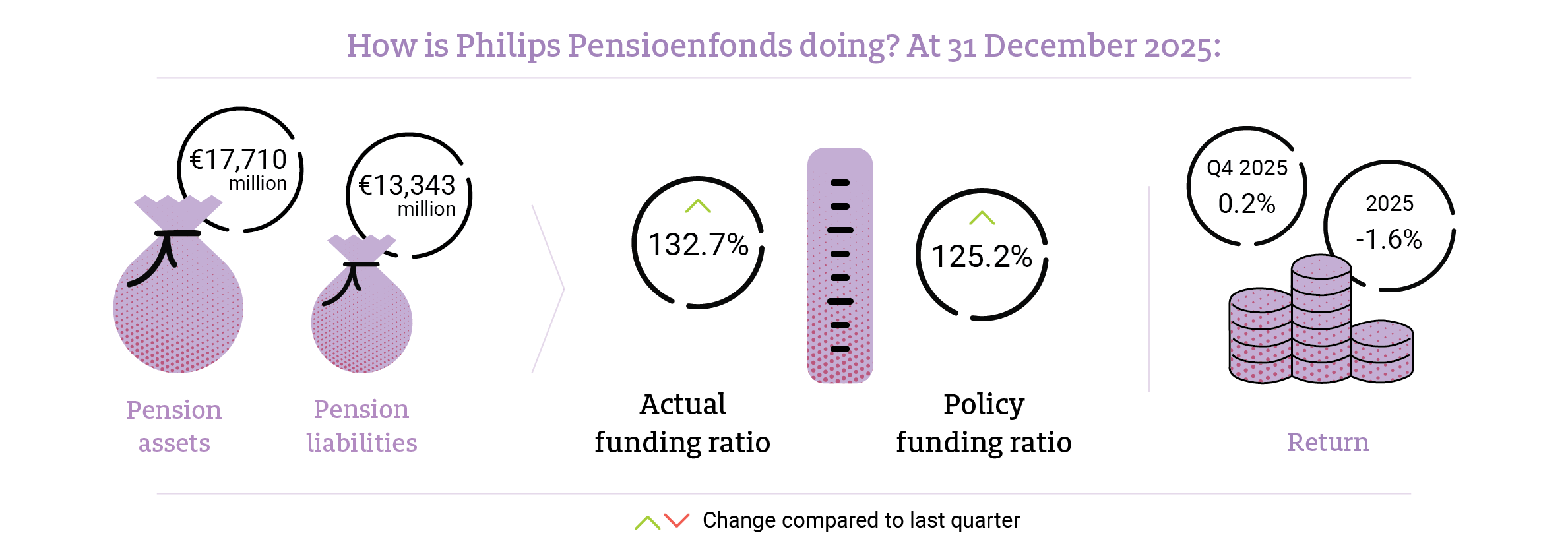

Financial position

Below you will find a brief summary of the most important information about the financial position of Philips Pensioenfonds.

- The actual funding ratio as at 31 December 2025 was 132.7%.

- The policy funding ratio as at 31 December 2025 was 125.2%.

- The assets returned 0.2% from 1 October 2025 to 31 December 2025.

- The assets returned -1.6% from 1 January 2025 to 31 December 2025.

- The value of the pension fund’s assets at 31 December 2025 was € 17,710 million.

- As of 31 December 2025, the pension liabilities were € 13,343 million.

Quarterly report

| Attachment | Size |

|---|---|

|

29 January 2026

Every quarter you can read in this report (in Dutch) how Philips Pensioenfonds is doing financially. |

401.45 kB |

More about the financial health of Philips Pensioenfonds

Read all information about the funding ratio and investment results here

Financial position

How healthy is your Pension Fund?

One of the factors used to determine the financial position of Philips Pensioenfonds is its funding ratio. If a pension fund has a funding ratio of 100%, this means that its assets are precisely enough for it to pay its existing pension liabilities.

More about Financial positionChart funding ratio

Here you will find the policy funding ratio of Philips Pensioenfonds every month.

Chart funding ratioInvestment results

Invest carefully for your retirement

The investment policy is based on an investment portfolio that distinguishes between fixed-income and variable-yield securities. The distribution at any point in time is aimed at having a good chance of achieving our ambition in the long term, a pension that is stable in value for pension recipients and non-contributory policyholders and a welfare pension for pension builders, without incurring excessive risks.

More about Investment resultsMore about our investment policy

Do you want to know more about the choices made by Philips Pensioenfonds in its investment policy?

More about the Investment policyFinancial crisis plan

What if a shortage situation threatens?

Every pension fund in the Netherlands is required to have a financial crisis plan in place. Philips Pensioenfonds’s financial crisis plan describes what action the Board of Trustees will take if the pension fund finds itself in a crisis situation, or if a crisis situation is imminent.

More about Financial crisis planCrisis plan summary

| Attachment | Size |

|---|---|

|

1 July 2025

|

388.8 kB |

Frequently asked questions

Would you like to know more?

Every quarter we publish current information about the financial position of the Fund in the quarterly report. The quarterly report can be found on the Pension Fund's website. In addition, you will find a graph showing the current level of the funding ratio each month. It is updated halfway through each month.

The funding ratio of the previous month is always published on the website around the fifteenth day of the month. After publication, a Twitter message is sent (via @PhilipsPensioen).

DNB publishes quarterly figures that are reported to DNB by the individual pension funds. Most of the information published by DNB can also be found on the Philips Pensioenfonds website. In the quarterly report of Philips Pensioenfonds you will find the policy funding ratio, the required funding ratio, the invested capital including the return on it. The so-called "premium coverage ratio" is published by Philips Pensioenfonds in its annual report. The quarterly reports and the annual report can be downloaded from www.philipspensioenfonds.nl/downloads

Related information

Is the information below perhaps also interesting for you?

Indexation policy

We try to increase your pension every year. This is called 'indexation'. But indexation cannot be taken for granted. Do you want to know more about our indexation policy?

Go to Indexation policy

Financial position

More about the financial health of Philips Pensioenfonds.

Go to financial position