Part 1: Why does Philips Pensioenfonds make investments?

Investing is the only way for us to make our pensions affordable

You probably have some idea of what investing involves. You also probably know that Philips Pensioenfonds makes investments. However, the risk appetite survey that was conducted among the members of Philips Pensioenfonds in early 2018 revealed that you would like to know more about the Pension Fund’s investment policy. That is why we have decided to include a series of articles about investment, to explain how we invest your pension and why. In this edition, we start at the beginning, and answer the question of why pension funds make investments. The simplest and shortest answer to that question is that it would be unaffordable to build up a proper pension fund without investing.

Keeping money in a mattress or a safe is a poor option for anyone

Say you put aside part of your salary every month, for example to save for your dream holiday or a new car. Even if you do not realise it, this situation is very similar to what happens at a pension fund.

You can do one of three things with the money that you save. You can keep the money somewhere in physical form, in a safe or stuffed inside the proverbial mattress. The next option is to keep it in a bank account. Lastly, you can invest the money. For large sums, you are unlikely to put it in your safe or mattress, given the risk of it being stolen. Given that Philips Pensioenfonds manages approximately 20 billion euros, you can see why we prefer not to stuff it in a mattress (or even a safe).

A savings account offers advantages, though not for a pension fund

Every euro that you stuff in that mattress is still worth one euro a year later. If you put that euro in a bank account, however, you will receive interest on it.

Moreover, in the Netherlands your savings are protected by the deposit guarantee scheme(1). If the bank goes bankrupt, you will get all your savings back. So essentially a bank account offers a double advantage: you cannot lose your money, and your money accrues value. In theory, pension funds could also put their money in bank accounts. However, this would be unwise. If the bank runs into payment problems and goes bankrupt, the value of the pension fund’s assets is too great to be covered by the deposit guarantee scheme, and the pension fund will lose all the capital that it had built up. In that scenario, Philips Pensioenfonds would not be able to pay its members their pensions.

Pension funds receive interest on government bonds

Pension funds can generate interest by buying government bonds. In this scenario, Philips Pensioenfonds effectively lends capital to governments of countries.

After some time, those countries repay the money that they have borrowed, with interest. Philips Pensioenfonds invests in many different countries, all of them with strong credit ratings; in practice this makes investing in government bonds a safe method for pension funds to benefit from interest. Essentially, investing in government bonds is as natural for pension funds as putting your money in a savings account is for you.

Pension funds invest in shares for higher returns

Another possibility is to invest your savings. Generally this refers to investing in shares, although investments in other asset classes are also possible.

For many people, investing in shares is difficult to picture. If Philips Pensioenfonds buys a share, effectively it buys a small piece of a company. In fact, you could say that the pension rights that you have accrued make you a co-owner of the companies whose shares Philips Pensioenfonds buys. Philips Pensioenfonds buys shares in different companies wherever it can. This helps to spread the risks as much as possible, and minimises losses on the share portfolio if the value of one or more companies plummets. Nevertheless, investing in shares carries more risk than buying government bonds. Companies go through good periods as well as bad patches, and an investment portfolio with shares can decrease in value over the short term. Investors are only willing to take this risk if they believe that they will be rewarded further down the road, so on average the returns that shares generate are higher than the returns on government bonds. In particular with money that can be invested for long periods of time, for example a pension fund’s capital, investing in shares is an attractive option.

Inflation consumes your pension

The additional returns realised on average from investing in shares are not merely a nice extra for pension funds: they are a vital necessity.

To return to the example of saving for a trip or a car: after a few years you will hopefully have enough money to afford that dream holiday or that fancy new car. Building up a proper pension takes decades, however. When you retire, what matters is not how much you have saved: instead, what matters is what you can buy for that money. For example, if everything that you buy goes up 2% in price every year, the effect in the short term will be small. After 40 years, however, you will need twice as much money to make the same purchase. The loss of your money’s value is called inflation. Unless we are careful, inflation will gradually consume your pension, and it is precisely to counteract this loss of your pension’s value that pension funds need to generate additional returns, which they do by investing in shares.

Investing in shares is necessary for indexing pensions

Philips Pensioenfonds has defined a real ambition. This means that we want your pension to buy you as much in the future as it does now.

To achieve this, we need to invest part of our capital in shares to ensure that your pension increases in value every year to match inflation. This is called indexation. Without inflation, Philips Pensioenfonds could simply invest in government bonds. Yet inflation does in fact exist, and in the long term it has a major impact. This is why it is necessary to invest in shares.

Philips Pensioenfonds invests in more than government bonds and shares alone

Although in practice Philips Pensioenfonds invests mostly in government bonds and shares, it also invests in other asset classes.

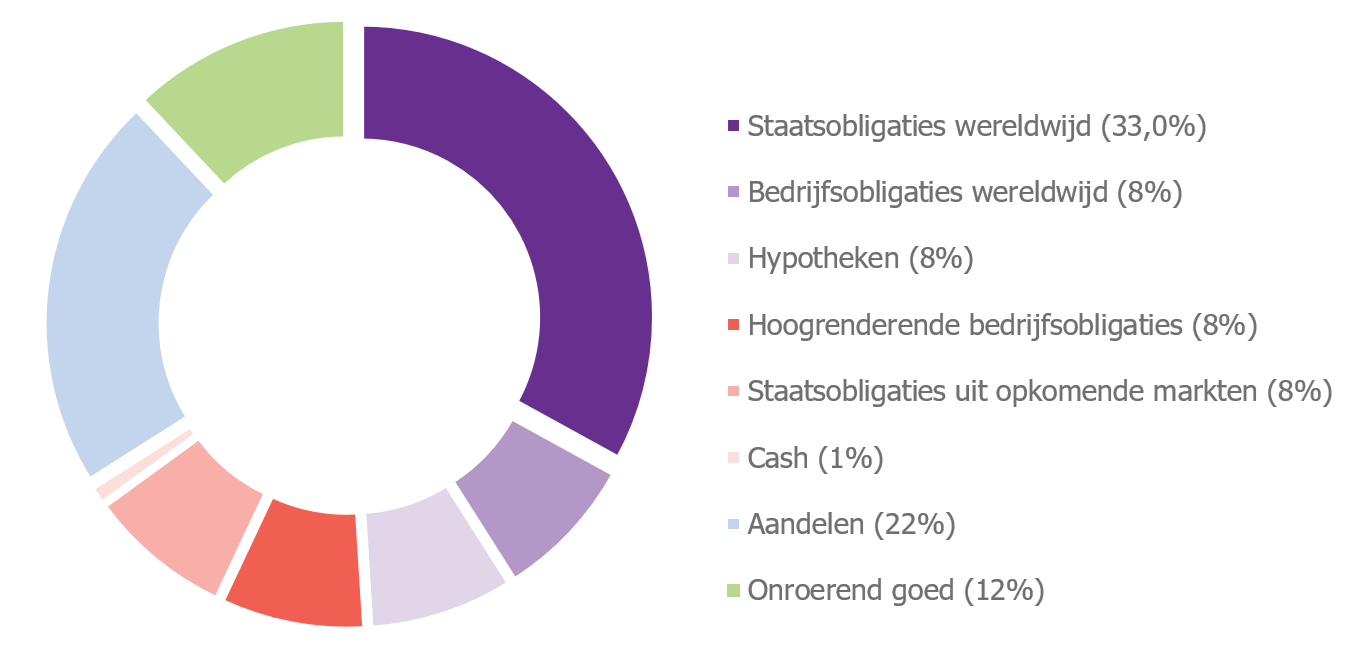

This is because the Pension Fund pursues a maximum spread of its investments, to avoid running any more risk than absolutely necessary when we invest your pension: if one asset class performs poorly in particular circumstances, it is very well possible that another asset class will experience an increase in value. We try to find the best possible balance between minimising risks and achieving sufficient returns to raise our pensions every year to match inflation. The pie chart above shows how much we invest in the various asset classes.

Investing increases the value of every euro contributed by around 2.5 times

To illustrate why investing is so vital, we finish with a sample calculation.

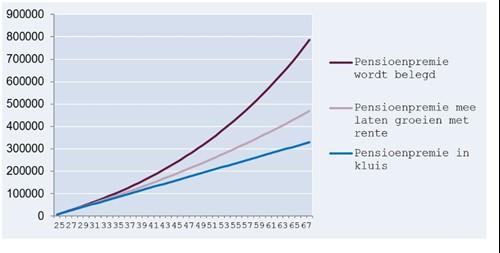

Imagine you are 25 right now, and will retire in 43 years’ time. Your employer pays the pension fund an annual pension contribution of 7,500 euros. You now have three options: you can put your pension contributions in a safe every year, you can generate interest on your pension contributions, or you can invest the pension capital.

The graph shows what your pension is likely to be worth after 43 years in each scenario(2). If the money is put in a safe every year, you will have saved 330,000 euros by the time you reach retirement age. As explained above, this money will buy much less when you retire than it does now, since inflation will diminish the purchasing power of your capital every year. If the savings are used to buy government bonds and the capital that you accrue can grow through interest, your pension capital will be almost 470,000 euros. This is much better. If the money is invested, however, it could be worth as much as 785,000 euros. Do you realise that investing will eventually increase the value of every euro contributed to your pension by almost 2.5 times? No mattress can compete with those numbers!

(1) The deposit guarantee scheme in the Netherlands covers savings of up to 100,000 euros, provided this does not concern subordinated deposits. More information.

(2) It is very difficult to predict what will happen on the financial markets. This example assumes, for the years ahead, an average interest yield of 1.5% and an annual investment return of 3.5%.

Part 2

In the next part of this series we will explain in which types of investments Philips Pensioenfonds does invest.