Part 2: In which types of investments does Philips Pensioenfonds invest?

In the first part of this series on investments, we explained why Philips Pensioenfonds invests. The short answer to that question is that without investments it would become unaffordable to accrue a pension. We also explained that the amount needed in pension contributions is based on the premise that your pension capital must grow at the same pace, at least, as the risk free interest rate. That is why Philips Pensioenfonds invests considerable part of its assets in government bonds. However, we also strive to allow for inflation indexation of these pensions. As the prices of goods and services increase every year, you will need more money to be able to consume the same products and purchase the same services. To ensure that your pension keeps pace with inflation, Philips Pensioenfonds has to invest in asset classes that are expected to yield a higher return, such as equities (shares) and high-yield corporate bonds. In this second part of this series on investments, we explain in which types of investments Philips Pensioenfonds invests and why. We also explain what the correlation is between returns and risks. However, we start by answering the question why pension funds need achieve a return on their investments.

Returns result from economic growth

Many people have difficulty imagining what returns are. How is it possible for something to suddenly be worth more?

To understand this, it is important to understand that the economic wealth increases every year. Generally speaking, because the economy will grow on average over time, we will be slightly wealthier tomorrow than we are today. Smart solutions help us on average to produce more per person per year. It also helps if the population of a country grows. As a result of these factor the economy grows slightly every year.

By investing a pension fund participates in a growing economy. For example, increasing tax revenues, because of greater economic wealth, allow a government to repay their loan to Philips Pensioenfonds with interest. In a growing economy, companies generally also realise more turnover and more profits, which increases their value. Philips Pensioenfonds invests in equity, which means that it is a co-owner in numerous companies. The value of its equity investments increases over time. This increased value is called ‘return’.

Risk and return go hand in hand

Although every investment benefits from economic growth, the degree to which a particular investment benefits ultimately depends on the level of risk involved. Risk and return go hand in hand.

To achieve higher returns, we have to take more risks. That seems counter-intuitive: taking more risks surely means the possibility that you will lose more on your investment. That is indeed true, and investors take this into account. An investor will only buy an investment if the price is at such a level that it can compensate for the associated risk over an extended period of time. Although the investor might suffer a loss in the short term, the fact that the economy generally grows means that in the long term returns on higher-risk investments will be greater than on investments that carry less risk.

Investments in government bonds bear the lowest level of risk…

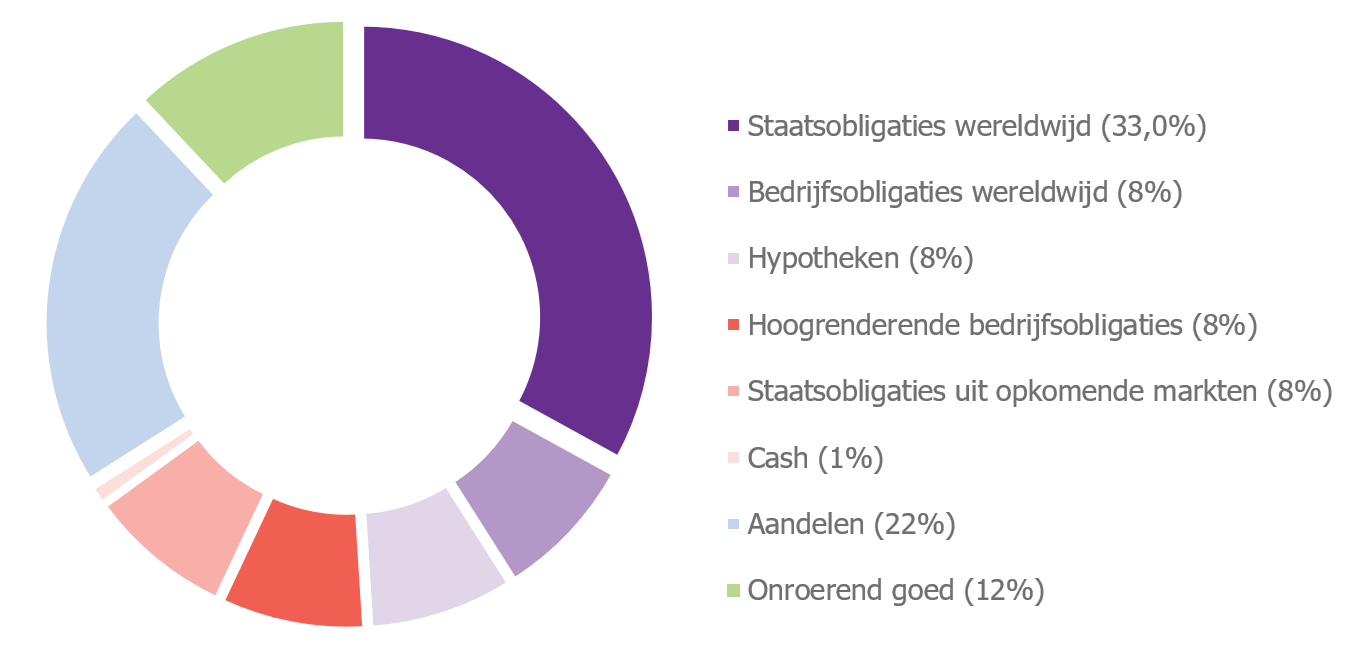

Of all the investments that Philips Pensioenfonds has, government bonds are the safest. The pie chart below shows that Philips Pensioenfonds invests 29% of its assets in government bonds.

In the first part of this series on investments we explained that government bonds are essentially loans provided to governments, which they repay with interest.

…corporate bonds and mortgages are also safe

Corporate bonds and mortgage loans are also among the investments that Philips Pensioenfonds holds that carry the least risk. Philips Pensioenfonds invests 7.5% of its assets in each of these two investment categories.

Corporate bonds are loans provided to companies. As with government bonds, where loans are only granted to countries with a good credit standing (in other words: countries that are financially healthy and that repay their obligations), in the case of corporate bonds, loans are only granted to companies that have a good credit rating. This means that the financial position of these countries and companies is robust to the extent that the risk of non-payment is small. The downside of this is that these investments yield lower returns. Through its investments in mortgages loans, Philips Pensioenfonds provides financing to households to purchases a home. These are also relatively safe investments.

Returns on government bonds, corporate bonds and mortgages are used to pay pensions

The reason why Philips Pensioenfonds invests 44% of its assets in safe investments is that these investments provide a low risk portfolio from which pension payments can be made with a high level of certainty. The other 60% of investments are used to provide additional return with the intention to allow the pensions to increase in line with economic growth(1).

(1) In addition to safe investments in government bonds, corporate bonds and mortgages, Philips Pensioenfonds also invests in cash. ‘Cash’ means loans to companies with a very high credit standing, that must be repaid within one year. Philips Pensioenfonds expects interest rates to increase in the coming years. Since cash investments are less susceptible to interest rate increases, Philips Pensioenfonds currently invests 7.5% of its assets in cash.

We take more risk to allow your pension to grow with inflation

However, Philips Pensioenfonds also has higher-risk investments. As explained before, to be able to index our pensions we need to take more risks.

Money loses value as the prices of goods and services increase every year. This is called inflation. To allow you to consume the same volume of goods and purchase the same number of services each year, your current or future pension growth needs to match the inflation rate. We strive to achieve the returns that we need for indexation by making higher-risk investments.

High-yield corporate bonds and emerging market government bonds carry slightly more risk

We invest 7.5% of our assets in high-yield corporate bonds. As the name implies, these corporate bonds yield higher returns. This also means that they involve more risk. The companies receiving these loans have less favourable credit ratings than normal corporate bonds. These types of investments carry a greater risk that the loan will be restructured or even default. However, Philips Pensioenfonds receives more interest on these loans compared with normal corporate bonds. The same principle applies to emerging market government bonds, in which we also invest 7.5% of our assets. As the economies of these countries are still very much in the process of development, the level of prosperity is lower than in countries such as the Netherlands, which has a high standard of prosperity. This generally means that emerging markets have fewer financial reserves. This type of investment also carries a higher risk that the government will be unable to repay its loan to Philips Pensionfonds. However, as with investments in high-yield corporate bonds, Philips Pensioenfonds is compensated for this: emerging markets pay higher interest rates on their loans compared with the loans that Philips Pensioenfonds provides to developed countries.

Equities and real estate carry the highest risks

Of all investments, investments in equities (shares) and in real estate involve the highest risk. Consequently, they generally tend to yield the highest returns.

Philips Pensioenfonds invests 27.5% of its assets in equities and 12.5% in real estate. With an equity investment, Philips Pensioenfonds acquires shares in a company. Shares carry a higher risk than corporate bonds. If the company goes into bankruptcy, the bondholders are repaid first. The shareholders will only be repaid if any assets are left. The same principle applies to investments in real estate: when it makes these investments, Philips Pensioenfonds becomes a co-owner of buildings that are let out to third parties.

In the next issue we will explain how Philips Pensioenfonds determines its investment mix

We hope that you now have a better understanding of how returns are achieved, why one investment yields a higher return than another, and what types of investments Philips Pensioenfonds holds. Another question, however, is why we invest 27.5% of our assets in equities, and not 25% or 40%. We will explain this in the next part of this series, when we discuss how we determine our investment mix.