New scheme for all participants

Planned transition on 1 January 2027

Since 1 July 2023, the Future of Pensions Act has come into force. All pension schemes in the Netherlands must be adapted to the new statutory pension rules no later than 1 January 2028. At Philips Pensioenfonds, the planned effective date of the new pension scheme is 1 January 2027. The new pension scheme will apply to all members building up pension, pension recipients and policyholders of Philips Pensioenfonds. So whatever your situation may be, everyone will be affected by the new scheme.

Information about the new pension rules

The new pension scheme, that we call the NexT Pension, will apply to participants of Philips Pensioenfonds from 1 January 2027. Only shortly before the introduction, it will become clear what the NexT Pension means for your personal situation. Before that happens, we will keep you informed of the expected timelines and what we already know about the scheme. We do this, among other things, with the questions and answers on this page. But we also work on articles and videos in which we always highlight a theme of the new pension rules and you'll find a roadmap with the most important landmarks in the decision making and communication. We will also keep you informed via our digital newsletter Gener@ties and our magazine Generaties.

The NexT Pension in brief

A personal pension with solidarity

The NexT Pension scheme will be a solidarity defined contribution plan. This is designed by the legislature to make pensions more personal, while still retaining elements of solidarity. In the new scheme, much remains the same, but there are also several changes:

What remains the same?

- A pension has been arranged for you after your retirement, in the event of disability and for your possible survivors after your death.

- You can make your own choices before your retirement.

- You will receive a pension for as long as you live.

- The pension savings are all invested collectively, the pension fund will invest the total pension capital of all its members together. This way you continue to share risks and costs with other participants.

What changes?

- Under the new pension scheme, you will have a personal pension capital. As soon as you retire, you will receive a monthly pension from your personal pension capital.

- The personal pension capital will follow economic developments. This can be both negative and positive.

- Are you retired? Once a year, we adjust the amount of your pension. We take measures to prevent decreases in the pension as much as possible.

Top 5 - Questions and Answers

More questions and answers can be found on the theme pages under ‘What will change’

Click here for an overview page with questions and answers

Before Philips Pensioenfonds adopts the future pension plan under the new pension rules, you will receive information explaining what this will mean for you personally. The new pension plan will start applying to you on 1 January 2027. Your information will become more and more personalised as the moment of the switch approaches. Until we can tell you how you personally will be affected, however, we will keep you updated about the process and the latest developments regarding the new pension rules. In addition, we can inform you in more general terms about what the new scheme is expected to mean for your future pension. You can read more about this in our communication plan.

In general, it makes no difference whether you retire (early) just before or just after the transition. Since the social partners (your employer and trade unions) have requested the Fund to make use of the option of transferring in, the new pension rules will also apply to the pension already accrued and the pension that already started before the transition to the new pension scheme.

Retiring early does mean that you are no longer entitled to the compensation scheme. The following applies to this: the abolition of the average system only applies to future pension accrual. If you leave employment or retire before the transition, there is no future accrual and therefore no disadvantage for our Pension Fund from the abolition of the average system. In that case, there is also no right to compensation. As a participant, you are wise to take the compensation into account when deciding on your retirement age or date of retirement. You will only receive the compensation if you are accruing pension with Philips Pension Fund at the time of transition. This also applies if your pension accrual with us is continued due to disability.

For current pension beneficiaries, the ratio between the accrued retirement pension and survivor's pension remains unchanged. This also applies to participants with a survivor's pension that deviates from the standard percentage of 70%. The amount of the survivor's pension may deviate from this, for example due to different percentages in the past and/or individual choices made on the retirement date. If the retirement pension can be increased by distributing the buffer at the time of transition to the new pension scheme, the survivor's pension will be increased proportionally, so that the ratio between the retirement pension and the survivor's pension remains the same after the transition.

No, you will receive a pension as long as you live. You don't have to worry about running out of money for your pension.

On the retirement date, the annual pension is determined partly on the basis of life expectancy. This concerns the annual pension that a participant receives from his or her own pension capital. You might then expect the pension capital to have run out as soon as a participant has reached that life expectancy. If a participant becomes older than expected, this participant would no longer receive a pension from that moment on. That is of course not the intention.

The Future Pensions Act stipulates that this so-called longevity risk must be covered. This way there is also pension income if one grows older than expected. The remaining pension capitalof participants who die earlier than expected are distributed among the participants who live longer than expected. The supplementation of the pension capital as you become older therefore takes place annually and gradually and not only from the moment you have become older than expected.

This does not mean, however, that a participant does not run any longevity risk at all. If fewer participants die than expected, less pension capital will be available than necessary to supplement the pension capital of participants who live longer. This effect is relatively limited in our Fund, because the number of participants who die each year is fairly stable due to our size. Finally, if not fewer, but more participants die than expected, more pension capital will be available to supplement the pension capital of participants who live longer.

All pension schemes must comply with the pension rules laid down in the Future Pensions Act. Every employer must therefore, in consultation with the trade unions or other employee representation, make agreements about a new pension scheme that complies with this new law.

The main rule in the new law is also that the accrued and commenced pensions are also converted to the rules of the new pension system. In pension jargon, we then speak of 'invaren' (conversion). It is possible to deviate from the main rule if this would lead to a disproportionate disadvantage for certain groups of participants. In the case of Philips Pensioenfonds the trade unions and employers have requested the Fund to convert the accrued and commenced pensions to the new pension scheme.

The decision that is to be taken, will apply to all pensions in the current system. The law does not include the option to choose to switch to the new pension rules or to remain in the current system.

The Board of Philips Pensioenfonds, which also represents employees and pension beneficiairies, will assess the request from trade unions and employers and must still make a final decision on this. It is legally stipulated that there is no individual 'right of objection'. Instead, there is the right to be heard for the pensioners' associations and an enhanced right to advise for the Accountability Body. All interest groups are represented in the Accountability Body, just like on the Board.

Themes: what will change?

Personal pension capital

Under the NexT Pension, you will have a personal pension capital, consisting of premiums contributed by you and your employer and investment returns.

Read more

Investing pension capital

We invest your personal pension capital for you, together with the pension capital of other members. In our investment policy, we take into account the ages of our members.

Read more

Pension contribution options

In the NexT Pension, you will be able to pay more pension contribution. Above a certain salary threshold, you can also choose to pay less.

Read more

Receiving variable pension

The pension you receive from your personal pension capital after retirement is not fixed in advance; it depends on the amount of your pension capital on your retirement date and the interest rate at that time.

Read more

Conversion of accrued pension

The the NexT Pension applies not only to pension accrual from that date, but also to all current accrued pensions and pensions that are being drawn.

Read more

Compensation

For some participants, the NexT Pension may result in a disadvantage in future pension accrual. They will receive compensation for this.

Read more

Survivors' pension

In the NexT Pension, your partner will receive a survivor's pension in the event of your death. The core remains that we relieve your partner of any concerns.

Read more

Increases transition period

Until the transition to the NexT Pension on 1 January 2027, the Board will assess annually whether your pension can be increased through indexation.

Read moreProcess towards your new pension

Before we can implement the NexT Pension, a lot is already happening ‘behind the scenes’. We would like to take you through the process that we are going through, together with all those involved. We will also indicate where we are now.

Decision-making process

How is the new pension scheme established?

What needs to be done to be able to carry out your new pension plan? Read how we decide on the NexT Pension and what we do behind the scenes to make the new scheme possible.

Read moreSummary communication plan

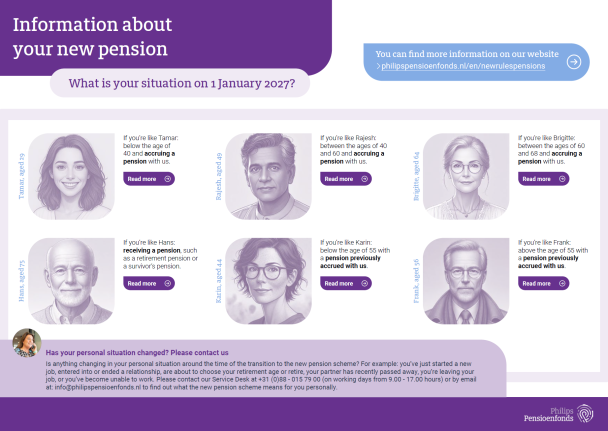

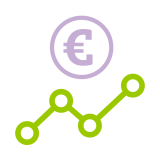

Would you like to know what the NexT Pension means for you? We have listed the most important messages in our communication plan. Choose the situation that suits you best and read what you can expect later. Would you like to know when you can expect information from us? You can also read that in the communication plan.

To communication planImplementation plan

In this plan (in Dutch) we will discuss the content, technical feasibility, costs and risks of (the introduction of) the NexT Pension. The conversion of accrued pensions to the NexT Pension (invaren) will also be discussed.

To implementation planTransition plan

All agreements about the NexT Pension have now been included in the ‘transition plan’. In this plan, the social partners explain why certain choices were made and which considerations (advantages and disadvantages) were taken into account. They also explain how the pensions already accrued will be dealt with.

Read moreNews items about the new pension scheme

We keep you informed of the latest developments with news and blog articles.

News: agreements on new pension plan are known

The social partners have made agreements about the new pension plan of Philips Pensioenfonds. In May 2024 it was already announced that the so-called solidarity-based contribution plan had been chosen. All agreements about the new pension plan have now been included in the 'transition plan'.

News: Switch to new pension plan scheduled for 1 January 2027

In about two years, all our members (active members, pension beneficiaries and members with a non-contributory policy) will switch to a new pension plan that aligns with the new legal rules for pensions. We recently decided on the scheduled date for the switch to the new pension plan: 1 January 2027.

View all news articles on our news page

Latest newsWhat do our participants think?

During our last annual participant survey, we asked members to share about their confidence in the new system. We consider the interest of all of our participants and constantly inform you about the developments. If you have any questions, do not hesitate to contact us. In addition, we ask for feedback on our communication and designs for the Pension Portal of the future.

Faith in the new pension system:

Active member: “I understand that change is needed and I also feel uncertainty about the fact that benefit will become more flexible. I am confident that pension funds are well aware of this and take the necessary precautions."

Retired member: "It seems to be a realistic method, which is also used abroad. With the previous change to FLEX pension, things have also improved, let's hope that this will also be the case concerning the new pension system."

Suspicion of the new system:

Active member: “In this new system, I might have less money when I need it most, and the media and peer reports are not positive."

Retired member: ""It's unfair to change the rules for people who already receive a pension. I can't take any additional measures now and I have little faith in the government."

Related information

The information below might also be interesting for you

Pensioen duidelijkheid (clarity about pensions)

An online platform created by the Ministry of Social Affairs and Employment with information about what the new rules entail.

Visit pensioenduidelijkheid.nl (Dutch only)

Overview news items

The annual increase in pensions must be sensible given that we want to transition to the new pension system on 1 January 2027 in good financial health. In the annual indexation decision, the Board explains how this assessment is made.

Overview indexation news