From arrangements about the new pension plan to ensuring a strong start for all our members

In May, we announced the news that Philips and the unions had agreed on the details of the future pension plan, and that they had decided on a solidarity-based contribution plan. It will be another two years or so before the new pension plan will come into effect, but even though that is far away, we are not sitting still now. Read on to find out more about the process ahead during the next two years.

New rules for pension

On this central page you find all the information on the new pension rules.

To central pageWhat you need to know right now

If everything proceeds according to schedule, Philips Pensioenfonds will carry out the new pension plan for all the Pension Fund’s active members, pension beneficiaries and policyholders: the new pension plan will impact everyone, whatever their situation. The solidarity-based contribution plan is a form of pension designed by the legislature to make pensions more personal, with every member having their own pension capital, combined with a collective financial reserve to offer protection against financial setbacks: the solidarity reserve. Precisely what impact this has on your personal pension situation will be explained shortly before we make the switch to the new pension plan. Before then, we will of course share more information about how things will change in general terms under the new pension plan. It also goes without saying that we will continue to handle your pension with our customary diligence.

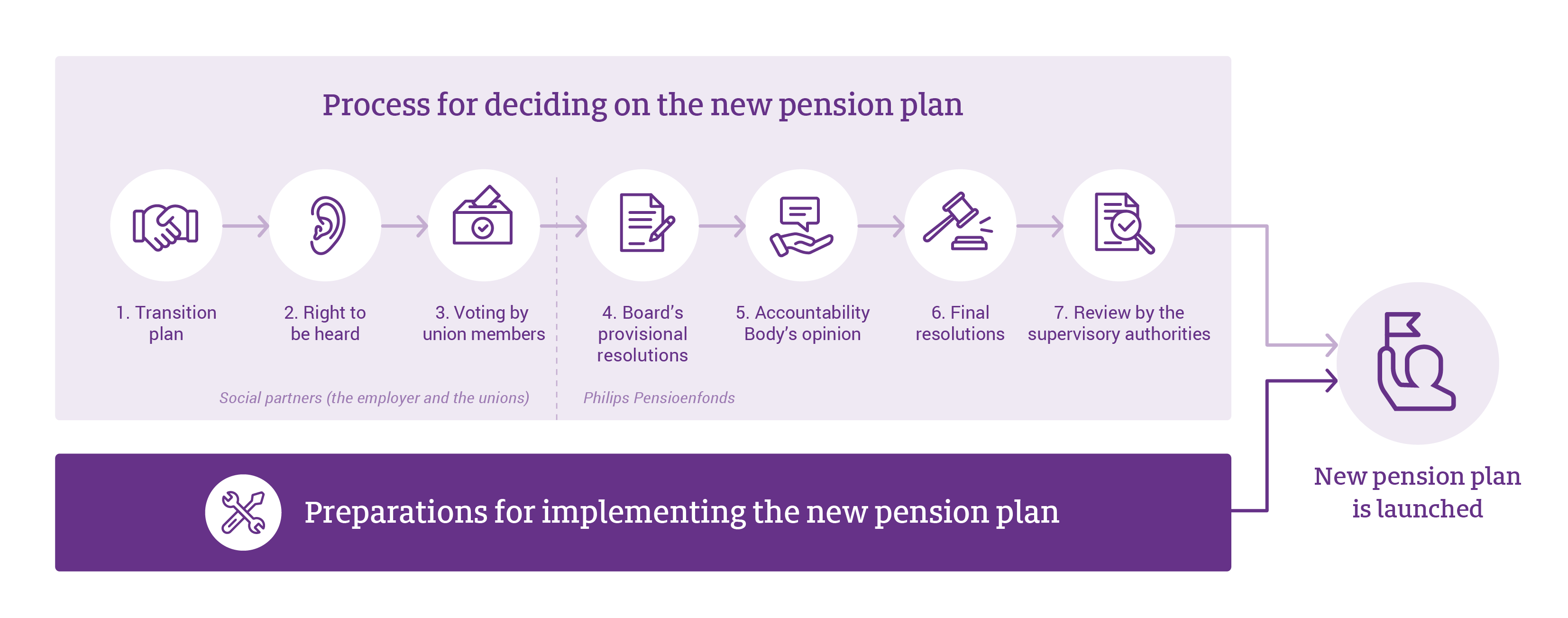

Summary: what are the steps along the road?

- Transition plan: The social partners (the employer and the unions) record each of their decisions in a transition plan, including what factors they have considered and the underlying calculations.

- Right to be heard: Associations of pension beneficiaries and non-contributory policyholders have the right to express their opinion on the transition plan: their ‘right to be heard’.

- Voting by union members :All union members are entitled to vote on the arrangements made in the transition plan; after their members vote about the transition plan, the unions decide whether the plan is final.

- Board’s provisional resolutions: The Board of Trustees of Philips Pensioenfonds reviews the arrangements made by the social partners, as described in the transition plan, to see whether they can be implemented and whether their impact on the Pension Fund’s members is ‘balanced’. The Board adopts a provisional resolution, i.e. how it intends to decide on the matter.

- Accountability Body’s opinion: The Accountability Body of Philips Pensioenfonds (with representatives from the employer, the employees and the pension beneficiaries) expresses an opinion on the Board’s provisional resolutions.

- Final resolutions: The Board takes the Accountability Body’s opinion into account when it finalises its resolutions on carrying out the new pension plan; if the Accountability Body does not express a positive opinion (or not unanimously), therefore, the Board might reconsider its provisional resolution.

- Review by the supervisory authorities: The Board finalises its resolutions and presents them to the supervisory authorities (the Dutch central bank (DNB) and the Dutch Authority for the Financial Markets (AFM). Those supervisory authorities review the submitted documents. They might have questions during the process. Ultimately, their approval is necessary before the new pension plan may be implemented.

Preparations for implementing the new pension plan: At the same time as these steps are taken in the administrative process, preparations are also underway for implementing the new pension plan: trialling the administration of the members, developing a new member portal (MijnPPF) and preparing the personal pension overviews to reflect the new pension situation.

1. Transition plan

The social partners (management and labour, i.e. the employer and the unions) record each of their decisions in a transition plan, including what factors they have considered and the underlying calculations. For example, the transition plan answers the following questions: What will happen with the pensions that members have accrued? How will the switch to the new pension plan impact the retirement pensions, survivor’s pensions and disability pensions of the separate groups of members? In what way is the switch balanced? The social partners completed a pre-draft version of the transition plan in September 2024, and shared it with the association of retired members in connection with the ‘right to be heard’.

Back to top

2. Right to be heard

A pension is an employment benefit. This means that designing the new pension plan is principally a task for the employer and the unions. However, the decisions that those social partners make also affect the pension beneficiaries and non-contributory policyholders, for example what to do with the pensions that they have accrued and what type of contract is chosen. Although they do not have a say in the negotiations, their interests are included in the arrangements between the social partners: the law dictates that the switch to the new pension plan must be ‘balanced’ for all our members.

It also requires a ‘right to be heard’ about the transition plan, meaning that the employer must give the association of pension beneficiaries and/or the association of non-contributory policyholders the opportunity to express an opinion on the plan. For Philips, the discussions that are based on the right to be heard are conducted with the Federatie van Philips Verenigingen van Gepensioneerden (FPVG, the federation of associations of Philips retirees). The social partners then provide feedback on how the FPVG’s input is given shape in their decisions.

3. Voting by union members

The arrangements about the future pension plan are made between the unions and the employer. Those arrangements are only finalised after a vote among the unions’ members. After the right to be heard has been exercised, the transition plan is presented to the members of the unions for a vote.

If and when their members vote in favour of the transition plan, the unions will decide whether the plan is final. This process is expected to be completed by the end of 2024. Although the transition plan contains the arrangements made by the social partners, not the arrangements of Philips Pensioenfonds, the Pension Fund will publish the finalised transition plan on its website by the end of 2024; this is required by law.

4. Board’s provisional resolutions

The Board of Trustees then has to review the finalised transition plan to determine whether the choices made by the social partners can in fact be carried out. This includes not only administrative practicability but also, and at least as importantly, aspects such as whether the choices are affordable (are the contributions agreed between employers and unions enough to realise the ambition?), comprehensible (will members understand the pension plan?) and above all balanced.

On the issue of balance: by law, the pension fund’s decisions are required to be ‘balanced’. The law does not explain what that means precisely; however, it is clear that various decisions are possible, which could all be balanced. At the very least, though, we need to carefully map out the implications of each of our decisions for each of the separate groups of members, and weigh the various pros and cons. This means that the Board will review the social partners’ decisions against the criterion of ‘balance’. In practice, we already shared a considerable amount of information with the social partners while the preparations were underway, to make sure that they knew when making their decisions how those decisions would affect our members.

The Board’s resolutions on the practicability of the new pension plan are scheduled to be completed before the end of 2024. The purpose of this timing is to make sure that the documents can be submitted to the supervisory authorities on time (see the notes below). Part of this process is about what the Board ‘intends’ to decide: some of the resolutions cannot be finalised until the Accountability Body has had the opportunity to express its opinion.

Back to top

5. Accountability Body’s opinion

The Accountability Body, made up of representatives of the active members, the pension beneficiaries and the employers, plays a key role in the process of designing the new pension plan. On some topics, the Accountability Body has the right to express an opinion. For example, the Accountability Body may give its opinion on the decision to convert the accrued pensions to the new pension plan and on how the pension fund’s assets are divided among the members’ individual pension capitals (‘entitlement conversion’, or invaren in Dutch).

The role of the Accountability Body in the switch to the new pension plan is particularly important, given that members cannot make individual decisions about matters such as the conversion of the accrued pensions to the new pension plan. The Accountability Body’s role should be regarded as extra assurance that the Board carries out its tasks in a balanced and responsible manner, with due allowance for the interests of all our members.

The Accountability Body will be asked to present its opinions by 1 March 2025 at the latest.

6. Final resolutions

If the opinions of the Accountability Body are positive, the Board can immediately finalise its resolutions. If some or all of the opinions are not positive, the Board will reconsider the resolutions, and if necessary discuss them further with the social partners. The resolutions cannot become final until after this has been done.

At this time, the law states that a record of the Board’s resolutions must be submitted to the supervisory authorities – the Dutch central bank (DNB) and the Dutch Authority for the Financial Markets (AFM) – by 1 July 2025 at the latest. The resolutions that the Pension Fund’s Board of Trustees adopts based on the transition plan need to be recorded in three prescribed documents:

- Implementation plan: this document is concerned chiefly with the technical practicability, the costs and the risks of introducing the new pension plan and converting the accrued pensions to the new pension plan (entitlement conversion, or invaren). The implementation plan contains the outlines of the various issues and considers those issues in relation to each other wherever possible.

- Communication plan: the communication plan is part of the implementation plan. It contains a description by the Pension Fund of how members will be informed about the implications of switching to the new pension plan. It also describes how the Pension Fund will communicate about compensation (where applicable) in connection with the abolition of the system of averaged contributions (click here for an FAQ about this topic and how that compensation will be financed).

- Conversion template: this is an Excel file containing a predefined format for answering questions about the new pension plan and the switch to that new pension plan.

7. Review by the supervisory authorities

The implementation plan and the conversion template should be submitted to DNB. The communication plan is presented to AFM. Once the documents have been submitted, time must be allowed for the supervisory authorities to review them. For example, DNB initially has six months to review the documents. That deadline may be extended twice, by three additional months each time. This does not start until DNB establishes that the file that is submitted is complete, and it is put on hold if the Pension Fund needs time to answer questions from DNB. In practice, all this means that it could take a year, or even longer, to obtain approval from DNB.

AFM has fixed moments for submitting the communication plan for review. If the plan is submitted at one of those moments, AFM will respond within 8 weeks. However, the communication plan needs to be submitted at the same time as the implementation plan; given this dependence, it is likely that the communication plan will not be submitted at one of the fixed moments, in which case AFM will apply the same timelines as DNB.

Preparations for implementing the new pension plan

Besides all the decisions that the social partners and the Pension Fund’s Board have to make, we also need to be prepared for carrying out the new pension plan. This involves a great deal of work that might not always be apparent to our members. Read on to find out more about some aspects of that work.

Robust pension records

Philips Pensioenfonds administers the pensions of nearly 100,000 members. Each pension is based on the member’s data, which are registered in the accounts and records: for example what the member’s salary is, how many years they have worked and what indexation they have received or foregone. It is therefore vital for pension funds to have good quality data in their records and a robust IT-system for administering their pension plan. When the pensions that members have accrued and are drawing are converted to the new pension plan, the Board wants to be able to state to a maximum degree of assurance that those matters are and will remain in proper order. To achieve this, we pay particular attention to managing the risks of data quality and the suitability of the administration system. The implementation plan will explain in detail exactly what efforts we have undertaken in this respect. Two examples are presented below:

- Quality of member data

Before the pensions are converted to the new pension system, Philips Pensioenfonds will carry out numerous checks of the data in the accounts and records. One of those checks is the annual review of the Pension Fund’s member data against the employee records of the affiliated companies. We also run similar checks at regular intervals against the data from the government’s Personal Records Database (BRP). These checks help us to keep our data accurate and up-to-date.

- Modifying the IT-systems

The requirements that the modified IT system must meet are determined in advance. Extensive testing takes place before the system is taken into use. The system is only implemented into use if these tests are positive. An example of a test is that applications that are linked to the IT system, such as the Pension Planner, continue to work even if many participants use that application at the same time. The system is then tested for peak load; this is also called a ‘load test’.

Compliance with laws and regulations and formalisation in the pension plan rules

The implementation plan will describe how the Pension Fund can carry out the pension plan in accordance with the legal rules. Next, the pension plan rules need to be drawn up as a formal record of the new pension plan.

How the new pension plan will affect you

We need to explain to each of our members how they personally will be affected by the new pension plan. To make sure that this matter is given the appropriate attention by all pension funds, and that they gear their communications to their own specific members, the law dictates that every pension fund must draw up a communication plan. Several communication moments are prescribed by law: for example, before the switch is actually made, members must receive a pension overview showing their provisional pension values under the new pension plan. However, their actual pension situation will not be certain until the switch: this will depend on the financial circumstances at that moment. As such, you will receive a finalised pension overview shortly after the switch, showing your pension values at the moment of the switch.

All communications need to focus on the specific implications for separate groups of members. This is described in the communication plan.

Designing the investment policy

The new pension plan will have a new investment policy, based on (among other factors) our members’ preferences; for example, you might have shared your input in the risk preference survey that we conducted in early-2024. Investing the pension capitals of our members according to that new policy from the moment that the new pension plan comes into effect requires extensive preparation.

This article provides some information about what we are doing in the process of switching to the new pension plan. We understand that the greatest concern for most of our members is how the new pension plan will affect their personal situation. Unfortunately, we will only be able to share details on an individual level shortly before the switch. In the meantime, however, we will keep you informed about the general outlines of the new pension plan, and how things will change in general terms under the new pension plan. We will also continue to address questions and possible misunderstandings. Click here to find all the information in one place: www.philipspensioenfonds.nl/en/new-pension-rules

With kind regards,

Jasper Kemme

Managing Director