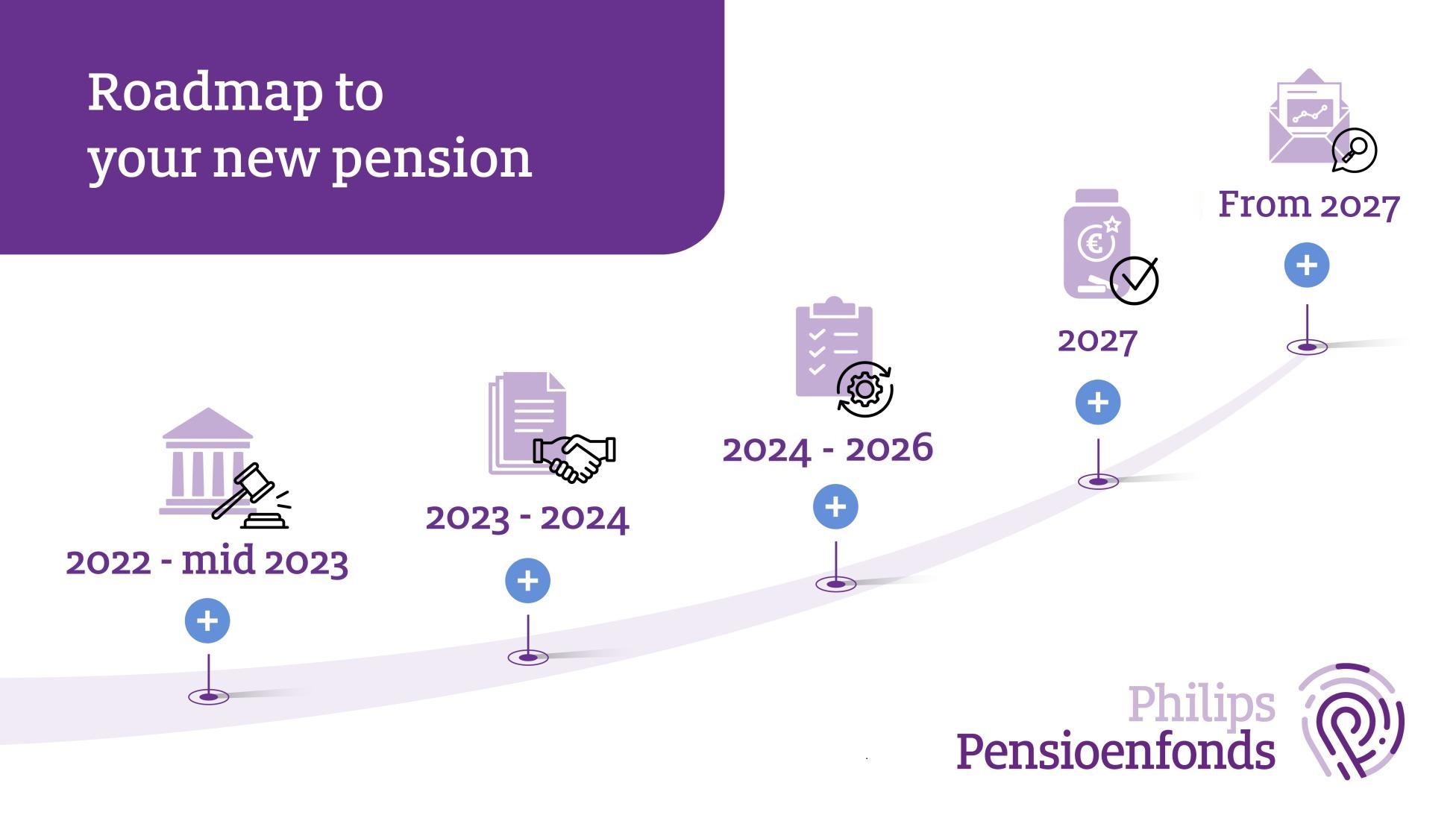

Together with the employers, we have put together a timeline to show what we are doing in the run-up to the new pension plan, and what to expect from us during each phase.

Roadmap to your new pension

Now that Parliament has adopted the Future of Pensions Act, we are gradually helping you to prepare for the changes that the pension system will undergo. You will be receiving information from the government and your employer as well. Together with the employers, we have put together a timeline to show what we are doing in the run-up to the new pension plan, and what to expect from us during each phase. The timeline is based on five milestones. Each of those milestones is explained here. Still, I definitely recommend that you take a look at the timeline, where all the information is presented in one place.

NB: at the end of 2024 the scheduled date for the transition has been set to 1 January 2027. Read more about the transition date in this article.

2022-mid-2023: The Future of Pensions Act is adopted

The new pension rules are laid down in the Dutch Future of Pensions Act (Wet toekomst pensioenen), which entered into force on 1 July 2023. However, this does not mean that your pension changed at the same time: employers and pension administrators have until 2028 to align their pension plans with the new legal rules. For members of Philips Pensioenfonds, we hope to have a new pension plan in place at some point during 2026.

2023-2024: your employer and the unions agree on the details of the new pension plan

The final decisions about the future pension plan will be made by the employers and the trade unions. Together, they will establish details such as what type of pension contract to choose: a solidarity defined contribution plan or a flexible defined contribution plan. Another issue that they will discuss is a hot topic: whether or not to transfer previously accrued pensions to the new pension system, through what is known as ‘entitlement conversion’ (in Dutch: invaren). All these arrangements will be recorded in a ‘transition plan’, which serves as the basis for when we switch to the new pension system. It will contain every decision, consideration and calculation underlying the transition to the new pension plan.

2024-2025: Philips Pensioenfonds prepares to implement the new pension plan

The Board of Philips Pensioenfonds will need to determine whether the choices made by the employers and the unions are practicable. This includes not only administrative practicability but also, and at least as importantly, aspects such as whether the choices are affordable (are the contributions agreed between employers and unions enough to realise the ambition?), comprehensible (will members understand the pension plan?) and above all balanced (have the implications for the various groups of members been mapped out properly, have the pros and cons been weighed carefully?).

We began preparing to implement the future pension plan in 2021, working together with partners such as our pension administrator and our asset manager. As soon as the details of the new pension plan become clear, we can get started on the concrete work of making sure that we can carry out the new pension plan from 2026 forward.

2026: you switch to the new pension plan

At some point during 2026, Philips Pensioenfonds will adopt the new pension plan. Our focus during that year will be on communicating with our members. In this phase, we will be able to tell you how the new pension plan will affect your personal situation. MijnPPF, our online environment, will have been given a complete update to align with the new pension plan, and we will be ready to answer all your questions.

2026-2027: Philips Pensioenfonds explains the new pension plan to you

Our work will not stop once the new pension plan is in place. We will help you to understand and keep track of your pension and to make decisions about your pension, for example if anything changes in your personal or work situation. Even under the new system, you will still need to think about your pension at those moments.

Jasper Kemme

Managing Director

Roadmap

| Attachment | Size |

|---|---|

|

6 November 2023

|

841.6 kB |

Related information

You might also be interested in the following information.

Members' panel

We would love to learn your thoughts on communication in connection with the Future of Pensions Act. Let us know if you would like to share your input.

Sign up

Watch a recording of the flashwebinar

If you would like some general information about the new pension rules, watch the recording of the flash webinar and the questions that were asked.

Flashwebinar recording