Converting the accrued pensions over to the NexT Pension, in short

- On 1 January 2027, all our members will switch to the NexT Pension. The NexT Pension plan will apply not only to pension accrual from that date onwards, but also to all pensions that have been accrued and are being drawn (called ‘accrued pensions’ here for easier reading). This means that you will also fall under the NexT Pension if you are already retired.

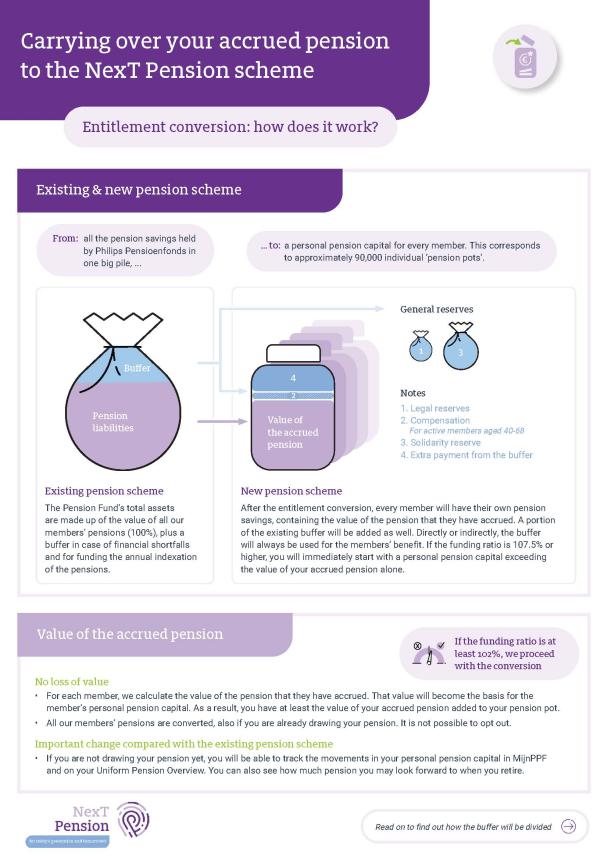

- Your accrued pension will be carried over to the new pension rules, in a process called ‘entitlement conversion’ (or simply ‘conversion’).

- We will convert your accrued pension entitlement into a personal pension capital. It will not lose any of its value: this is governed by legal rules to prevent that. This change is the same for all our members. You do not have the option of deciding against it.

- If the Pension Fund’s finances are healthy, you may also look forward to a share in the financial buffer, so your personal pension capital when we switch to the new pension plan will be higher than the value of your pension entitlements.

Attention

Before the conversion of the accrued pensions to the NexT Pension can be finalised, it first needs to be approved by the Dutch central Bank (DNB) as our supervisory authority.

Philips Pensioenfonds explains

In this video, Pensions Director Mike Pernot explains how entitlement conversion works and how it might impact you. Precisely how each group of members will be affected by the switch to the new system will only become clear shortly beforehand. Personal information will be provided at the end of 2026.

The explanatory video provides a simplified explanation of entitlement conversion. This means the information isn't entirely comprehensive and/or doesn't cover all the nuances. Want to know exactly how it works? Then also check out the questions and answers below or read the implementation plan.

Attention! This is a video with English subtitles. You may need to turn on subtitles via the cc-button at the bottom of the screen.

Frequently asked questions

Frequently asked questions about converting accrued pensions to the new pension scheme

The pensions of pension beneficiaries, active members and non-contributory policyholders that have already been accrued at the time of the transition to the new system will be converted to the new pension scheme. In pension jargon, we then speak of 'itransferring' ('invaren').

The decision of the pension fund board to transfer is binding for all participants of the fund. There is no individual right of objection. However, the Accountability Body must give advice on transferring.

The idea of the conversion is that the advantages of the new pension rules should also apply to the accrued pensions. It will be more likely that the pensions can be raised, although the pensions might also need to be cut, for example if the investments yield poor returns. We will use a collective ‘solidarity reserve’ to largely avoid the risk of needing to cut the pensions. It is also more efficient and cost-effective for the pension fund to only administer one pension plan. The employers and the unions/employee representatives have asked Philips Pensioenfonds to convert the accrued pensions. By law, too, the basic rule is that the pensions will be converted; the only situation where they do not need to be converted is if it can be demonstrated that specific groups of members would be negatively impacted. Philips Pensioenfonds’s Board of Trustees and Accountability Body have reviewed the arrangements to see whether they are balanced, and have expressed a favourable opinion. Both those bodies include representatives of active members and pension beneficiaries. Others share their input too, for example the key function holders and DNB, our supervisory authority.

No. The decision applies to the pensions accrued in the current pension scheme of all participants and it is not possible to leave those pensions in the current scheme.

After the entitlement conversion, your personal pension capital will be made up of the value of the pension that you accrued before 1 January 2027, plus a share in the pension fund’s buffer at that date (assuming that the buffer is large enough). Your pension will not lose any of its value as a result of the conversion: this is governed by legal rules to prevent that. Under those legal rules, your personal pension capital must be at least the same as the value of your accrued pension, provided that the funding ratio at the time of the conversion is greater than 102%.

The portion of the funding ratio that is greater than 100% is our ‘financial buffer’. We maintain that buffer in case of financial shortfalls and to fund future indexation. Under the new pension plan, the pension fund no longer has to maintain any large reserves, though, so when the pension fund converts the accrued pensions, part of the financial buffer will be allocated to each member’s personal pension capital. The larger the buffer is, the more money can be shared. At the end of 2024, Philips Pensioenfonds had a buffer of about 23%.

Arrangements have been made about how the buffer will be shared. One way or another, the buffer will be used for the benefit of the members, either directly or indirectly:

- We will use part of the buffer to set up some ‘reserves’, for example an operational reserve to cover unforeseen expenses.

- Part will be used to compensate active members who suffer a disadvantage when the averaging method used under the current pension plan is abolished.

- Part will be used to create the solidarity reserve to protect current and future pension beneficiaries against pension cuts if the investment yields and other results fall short.

- The balance of the pension fund’s assets will then be shared among all our members’ personal pension capitals, on top of the value of their accrued pension.

For more information about the allocation key, see the question: ‘How will the pensions be converted to the personal pension capitals?”

Philips Pensioenfonds administers the pensions of almost 90,000 members. Each pension is based on the member’s data, which are registered in the accounts and records: for example what the member’s salary is, how many years they have worked and what indexation they have received or foregone. It is therefore vital for pension funds to have good quality data in their records and a robust IT system for administering their pension plan. When the pensions that members have accrued and are receiving are converted to the new pension plan, the Board wants to be able to state with the greatest possible degree of assurance that those matters are and will remain in proper order. To achieve this, we pay particular attention to managing the risks of data quality and the suitability of the administration system.

Quality of member data

Before the pensions are converted to the new pension system, Philips Pensioenfonds will carry out numerous checks of the data in the accounts and records. An example is the annual review of the Pension Fund’s member data against the employee records of the affiliated companies. We run similar checks against the data from the government’s Personal Records Database (BRP). This way, we keep our data accurate and up-to-date.

Updating the IT systems

The first step is to define the requirements that the updated system should meet. Before the new IT system is taken into use, it is first subjected to extensive testing. The system will not be taken into use until all the tests have been completed successfully. One of the tests might involve checking whether applications that interface with the IT system, such as the Pension Planner, will still work when they are being used by large numbers of users. The system will be tested for its peak load, in what is commonly called a ‘load test’.

The ‘allocation key’ or ‘conversion method’ reflects how the Pension Fund’s financial buffer will be shared among each member’s personal pension capital.

In the existing pension system, Philips Pensioenfonds has a realistic ambition: the Pension Fund wants full pension accrual and full indexation for all its members. The realistic ambition was the basis for deciding how to give shape to the new pension plan under the new system and the transition to that new pension plan.

The Pension Fund’s realistic ambition was also the basis for the decisions on the most balanced way of achieving this. With this ambition in mind, it is appropriate and fair to take into account both past indexation arrears and future indexation when allocating the buffer that has been built up under the existing pension system. Ignoring past indexation arrears would impact on older members in particular, while not considering future indexation would disadvantage younger members more.

For the allocation key in the transition plan of social partners of the employers, it is decided to adopt the ‘50/50’ method. With this method, indexation arrears carry as much weight as future indexation. To avoid confusion: 50/50 does not mean that the share of the Pension Fund’s assets that goes towards indexation arrears is the same as the share going to future indexation. So what does it mean? Each member’s personal pension capital will include an amount for financing a specific percentage (one that is the same for everyone) for the future indexation ambition, plus an amount for financing the same percentage of the indexation arrears (calculated in a uniform manner).

Financing indexation arrears is relatively more costly for older members, who have accrued more pension than younger members. Younger members, however, need relatively more money to realise future indexation than older members do: the future indexation for younger members needs to be financed over a longer time.

No, there are legal calculation rules for the distribution of the pension assets upon commencement. One of the conditions is that participants receive at least the value of the accrued pensions paid into their pension pot, provided that the funding ratio of the Fund is sufficient (more than 102%). An other question explains how the Fund's buffer is subsequently distributed upon entry.

If our finances are healthy enough, the conversion will add more value to your personal pension savings than just the value that your pension has accrued by then. Each member’s personal pension capital, including their share in the buffer, will be allocated at the moment of the switch:

- For pension beneficiaries, this means that the pension that they are already drawing may be raised as soon as we make the switch, if the funding ratio is high enough. For a more detailed answer to the question of what the advantages and risks are for pension beneficiaries, see the question: ‘Will retired members be disadvantaged by entitlement conversion?’

- Active members and non-contributory policyholders will see the extra addition to their personal pension capital on the pension overview that they receive after we make the switch to the new pension plan. The information will also be available in MijnPPF. When you retire, we will calculate how much pension you can draw from your personal pension capital.

The new pension system must of course be compliant with the relevant laws and regulations. That includes European regulations - and in this case specifically the European Convention on Human Rights and Fundamental Freedoms (ECHR), which states that every person is entitled to the peaceful enjoyment of his or her possessions. At a minimum, this covers the pensions that employees and retired members have previously accrued. EU Member States have the authority to deprive persons of their possessions or to control property if this is required for reasons of public interest. The ECHR lists a series of criteria for determining whether the deprivation of possessions or control of property is legitimate. Ultimately, the European Court of Human Rights will have to decide whether those criteria are satisfied. In the memo that Social Affairs and Employment (that later became the Future Act of Pensions) Minister Wouter Koolmees presented to the Dutch House of Representatives on 22 June 2020, describing the main principles for the practical details of the National Pension Agreement, it is assumed that the likelihood that the European Court will rule, if asked, that these criteria are not met, is small: ’Potential risks of an unjustified infringement of the right to own property will be (...) very minor.’

In January 2027, you will still receive the same gross pension amount as in December 2026. This is because the transition of pensions (“invaren”) based on the funding ratio as of 31 December 2026 will not yet be completed. In February 2027, this process will be finalized. In February, you will receive your new pension amount—which includes the increase resulting from the distribution of the buffer—as well as a retroactive payment of the increase for January. From March 2027 onward, you will receive the new pension amount each month.

We will illustrate this with an example calculation (all amounts are gross). Suppose:

- your monthly pension is currently €1,000

- during the transition, you receive a 10% increase

- your new monthly pension amount will then be €1,100

You will then receive:

- in January 2027: €1,000

- in February 2027: €1,200 (€1,100 for February plus a retroactive payment of €100 for January)

- from March 2027 onward: €1,100 per month

The calculations from the transition plan look positive for all participants. If the funding ratio is 120% when we switch to the new pension plan, we expect the effects to be as shown below. The advantages mentioned in the first two points of the list below will be smaller, of course, if the funding ratio is lower than 120% when we make the switch, and greater if it is higher. If the funding ratio drops below 115%, this will also negatively affect the degree of protection that the solidarity reserve can offer.

- Immediately after we make the switch, every member will have a higher pension than under the existing pension plan. For our pension beneficiaries, it will be an increase of 5-8%.

- All our members are also expected to have a higher pension than under the existing pension plan over the entire period that they draw their pension.

- The so-called solidarity reserve provides pensions that are already being drawn with a high degree of protection against cuts. Pensions that have previously gone up are also strongly protected against cuts. The protection means that it will be less likely than under the existing pension plan that we have to lower the pensions that are being drawn.

- Measured over the long term, the pensions are expected to go up by an average of 2% per year. This means that the pensions are expected to retain at least most of their purchasing power.

This sounds very encouraging. Are there any risks?

Yes, of course this comes with some risks. Developments on the interest and stock markets are unpredictable, and investment yields could fall short of expectations. Inflation could be higher than we currently foresee, which would erode the pensions’ purchasing power over time. These risks already exist under the pension plan that we have now. Under the existing pension plan, the Pension Fund is required to maintain a buffer, which offers members protection in case the investment returns fall short. So how does this work under the new pension plan?

Risks for pension beneficiaries

In the new pension plan, pension beneficiaries of Philips Pensioenfonds are protected against shortfalls in investment returns by the solidarity reserve. At the time of switching to the new pension plan, that reserve will be filled using the Pension Fund’s buffer. Later, it will be topped up by withholding small amounts from the positive investment yields of the pension beneficiaries and other members aged 55 and up. The solidarity reserve will be used to top up your pension if it would otherwise need to be lowered. However, this is possible only if the solidarity reserve contains enough assets.

Risks for active members and non-contributory policyholders

The solidarity reserve does not protect active members and non-contributory policyholders before they start drawing their pension. The new pension plan will not include a financial buffer, meaning that negative investment returns will have a direct negative impact on the personal pension capital of those members, and on their expected pension. At the same time, however, positive investment returns will cause a direct increase in their expected pension. Under the existing system, positive investment yields are generally only used to increase the buffer, and so improve the funding ratio. A member’s pension (actual or expected) only goes up if the Pension Fund can award indexation (including compensatory indexation) on the pensions.

No. Only the available assets at the time of conversion can be divided. The affiliated companies are not obliged to make additional contributions.

Related information

The information below might also be interesting for you

Personal pension capital

In the NexT Pension, you will have a personal pension capital. This capital consists of premium from you and your employer and investment results.

Read more

Survivors' pension

In the NexT Pension, your partner will receive a survivor's pension in the event of your death. The core remains that we relieve your partner of any concerns.

Read more