Changes to the disability scheme

As of 1 January 2025, the disability pension scheme has been amended in the following key areas:

- the waiting period will increase from 3 years to 2 years, and

- the disability benefit threshold will be linked to the Work and Income (Capacity for Work) Act (WIA). This results in a higher disability benefit threshold.

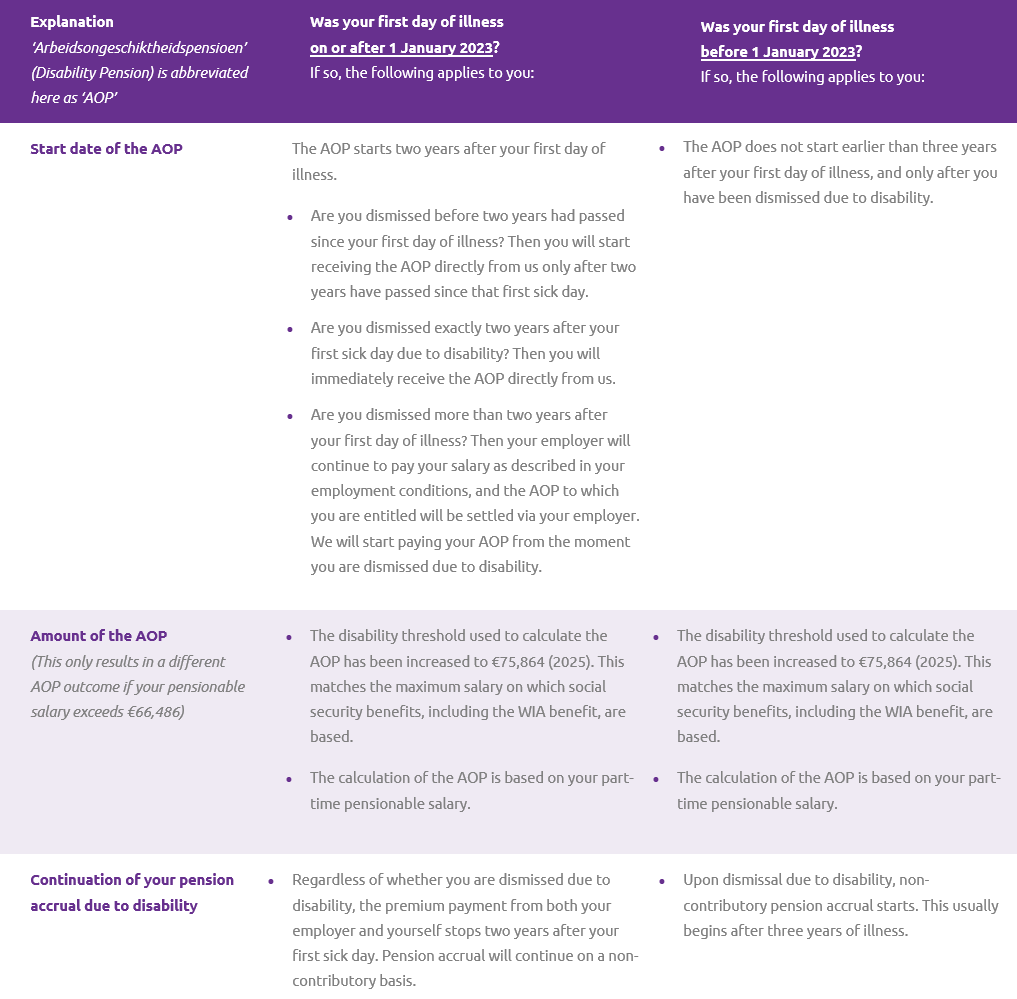

These changes bring the scheme more in line with the statutory WIA regulations. Our website provides information about the scheme for participants whose first day of illness falls after 1 January 2023. If your first day of illness falls before 1 January 2023, different rules apply. Below, you can see in one overview which situation applies to you.

You will also find questions and answers at the bottom of this page

Questions and Answers

About changes in the disability scheme

Information about disability pensions can be found in the following places:

- On the Uniform Pension Overview you receive each year. This overview is always based on your data on January 1st of that year. Therefore, on your Uniform Pension Overview 2025, you will see the disability pension based on your pension data as of January 1st, 2025 (including your pensionable salary, which is determined annually in April; therefore, the pensionable salary from April 1st of the previous year applies on January 1st).

- On the 'My Pension' page in MijnPPF. You will find up-to-date information about disability pensions under the 'If I become disabled' tab.

Note: Your pensionable salary from April 1st prior to your first day of illness is used to calculate your disability pension. Any collective scale adjustments that occur between April 1st and the first day of illness and April 1st before the start date of your disability pension will be taken into account. The amount of your disability pension and the premium-free continuation of pension accrual will be finalized if you have been ill for two years and are formally declared fully or partially disabled by the Employee Insurance Agency (UWV).

The disability pension scheme has been amended in several aspects as of 1 January 2025. The changes were agreed upon by your employer and the employee representatives. Philips Pensioenfonds administers the scheme and has amended the pension regulations accordingly, effective January 1, 2025.

The agreements made during the consultation between your employer and the employee representatives are intended to better align the disability pension scheme with the statutory disability scheme: the WIA (Work and Income according to Capacity for Work Act).

Aligning with the target: 75% of your salary prior to disability

This means that the changes better align the disability pension (AOP) with the target of this supplementary income during disability: ensuring that the total income during disability is 75% of the salary prior to disability. Previously, it was possible for the AOP combined with the WIA benefit to exceed 75% of the salary prior to disability. This meant that the scheme was more generous than intended for some participants, particularly those who work part-time and/or those with an income exceeding €66,500.

Better alignment with the start date of the WIA (Work and Income according to Capacity for Work)

Another change is intended to better align the start date of the AOP (General Pension Act) and the premium-free continuation of pension accrual with the start date of the WIA benefit. Previously, the AOP did not start until after three years of illness (a so-called three-year waiting period). This meant that if your employment was terminated due to disability before three years of illness, the Philips Pensioenfonds AOP would start (up to) one year later. Now, a two-year waiting period applies, just like with the WIA, meaning the start date of the AOP aligns with the start date of the WIA. The change also means that the premium-free continuation of pension accrual begins after two years of illness (instead of a minimum of three years), meaning your personal contribution to pension accrual will be reduced sooner if you are (partially) unable to work due to disability. In the case of full disability, you will no longer pay any premiums after the two-year waiting period. You will see this on your salary specification.