Lump sum, what to consider?

Before you retire, you have a number of choices to suit your pension to your personal situation. The option 'lump sum' will be added soon. From 1 January 2026 at the earliest, a maximum of 10% of your accrued retirement pension can be paid out at once when you retire. That sounds appealing, but what to consider before you make the choice? Read it below.

Retiring soon?

And do you want to know what this choice means for you personally? Are you even considering postponing your retirement? Then make an appointment for a video call with our customer service.

Make an appointment

Why (not) to opt?

Read here why or why not to opt for 'lump sum', for example the lifelong lower monthly pension income

Read more

Taxes and surcharges

Read about the possible consequences for taxes, income-related arrangements and/or surcharges

Read more

Getting a mortgage

Read here about the consequences of 'lump sum' for (partial) repayment or getting a mortgage

Read more

In the event of death

Read here what happens to the survivor's pension and/or payment in the event of death

Read more

Pension system

Read about the consequences of the new pension system if you opt for 'lump sum'

Read moreTake your time to make a choice

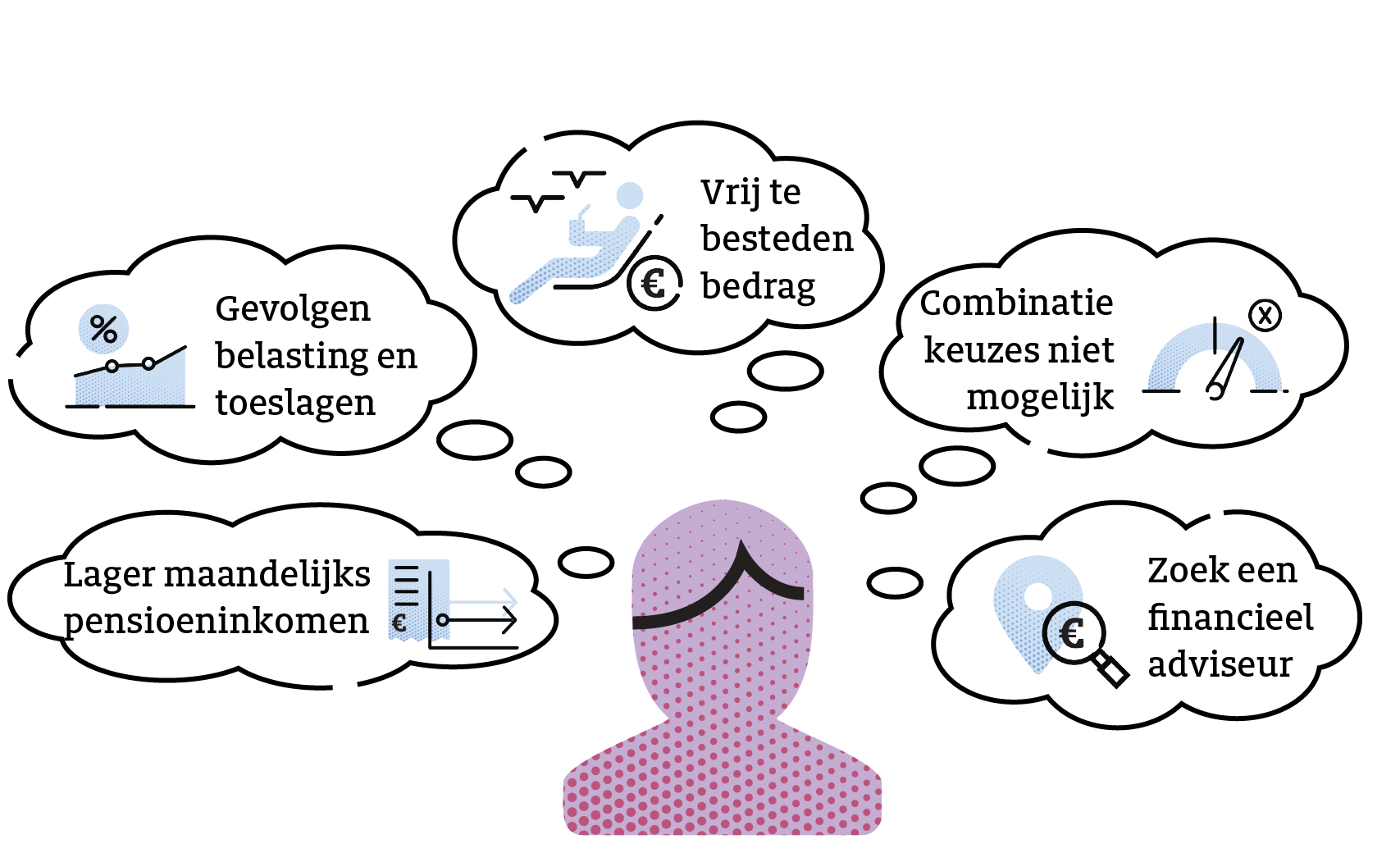

The choice for 'lump sum' can have all kinds of consequences for your (future) situation. We have mentioned a large number of considerations above, but this overview is not exhaustive. If you opt for 'lump sum', the option to opt for the high/low arrangement and the purchase of bridging pension will disappear, while those choices may suit your situation better. Just like the other choices in retirement, 'lump sum' is also a choice that cannot be reversed. That is why we think it is important that you also discuss your options with a financial advisor. He can also estimate the long-term effects for your overall situation. In our Pension Planner we do not take among other things, taxes and surcharges into account; an financial advisor will.

Just a little patience

You can legally make the choice for 'lump sum'. It is only uncertain what option will be offered to postpone payment until after the state pension age. It seems the legislation will take effect from 1 January 2026. Are you retiring before that date? Then you cannot opt for 'lump sum'.

What do our participants think?

Charles (47)

"When you retire, you are in a position that you can only generate little extra money. The pension income is then your fixed income. You should stay away from that."

Yvonne (59)

"I think it's a good idea. I expect to be healthy at the start of my retirement and as I get older I need less money. I would rather do nice things at the start of my retirement, for example long distance travel."

Frequently asked questions

about the option 'lump sum'

Het is al zeker dat u wettelijk de keuze voor ‘bedrag ineens’ kunt maken. Maar het ingangsmoment is op dit moment nog niet 100% zeker. Het lijkt er nu op dat het ingangsmoment 1 januari 2026 wordt. Ook is nog onzeker of de mogelijkheid wordt geboden om de betaling van het bedrag ineens uit te stellen.

Bent u al met pensioen als de regeling ingaat? Dan kunt u geen gebruik meer maken van de mogelijkheid 'bedrag ineens'. Bent u op dat moment met deeltijdpensioen? Dan kunt u maximaal 10% van het nog niet uitgekeerde pensioen in één keer opnemen. U beslist ongeveer een half jaar voordat u (volledig) met pensioen gaat, of u gebruik wilt maken van ‘bedrag ineens’. U krijgt op dat moment informatie over de keuzes die u kunt maken en we nodigen u uit om naar de Pensioenplanner te gaan om uw keuzes door te rekenen.

Gaat u binnenkort met pensioen en wilt u weten wat deze keuze voor u persoonlijk kan betekenen? Of overweegt u zelfs uw pensioen uit te stellen? Maak dan een afspraak voor videobellen.

U ontvangt het 'bedrag ineens' in principe tegelijk met uw eerste pensioenbetaling. Mogelijk mag u de uitbetaling van het bedrag ineens uitstellen als de ingang van uw pensioen samenvalt met de maand waarin u uw AOW-leeftijd bereikt. U ontvangt het bedrag ineens dan in de maand januari daaropvolgend. U betaalt dan minder belasting over het bedrag, omdat u als AOW-ontvanger meestal in een gunstiger belastingtarief valt. Het is dus nog niet zeker of het uitstellen van de uitbetaling mogelijk is binnen de regeling.

Wettelijk gelden de volgende voorwaarden om gebruik te maken van ‘bedrag ineens’:

- U mag maximaal 10% van de waarde van uw ouderdomspensioen in een keer laten uitbetalen, minder mag ook.

- Uw pensioen moet na ‘bedrag ineens’ hoger zijn dan de wettelijke afkoopgrens. Deze grens is in 2026 € 632,63 bruto per jaar.

- U mag een keuze voor ‘bedrag ineens’ niet combineren met twee andere keuzemogelijkheden die invloed hebben op uw levenslang pensioen: de hoog-laagregeling of de inkoop van overbruggingspensioen.

U mag een keuze voor ‘bedrag ineens’ niet combineren twee andere pensioenkeuzes die van invloed zijn op uw levenslange pensioen. Daarom is het niet mogelijk om te kiezen voor ‘bedrag ineens’ in combinatie met de hoog-laagregeling (eerst een hoger pensioen en daarna een lager pensioen) en ook niet in combinatie met de inkoop van overbruggingspensioen (tijdelijk pensioen als u eerder dan de AOW-leeftijd met pensioen gaat).

De Belastingdienst ziet het ‘bedrag ineens’ als inkomen waarover u belasting moet betalen. Dat kan verschillende gevolgen hebben. Zo valt u mogelijk in een hogere belastingschijf. U betaalt dan een hoger belastingtarief over het ‘bedrag ineens’ dan over uw maandelijks pensioen. Ook moet u over het ‘bedrag ineens’ waarschijnlijk premie voor de Zorgverzekeringswet betalen. Ontvangt u toeslagen, zoals huur- en/of zorgtoeslag? Dan kan die toeslag lager worden of zelfs vervallen. Dit geldt ook voor andere inkomensafhankelijke regelingen waar u misschien gebruik van maakt. Het ‘bedrag ineens’ kan dus fiscaal nadelig zijn. Daarom is het altijd verstandig om uw persoonlijke situatie op een rij te zetten met een financieel adviseur.

Kortgezegd betekent bedrag ineens ‘nu meer geld, maar straks minder’. Uw totale pensioen heeft een bepaalde waarde. Als u 10% van de waarde van uw ouderdomspensioen ineens laat uitbetalen, blijft er ook 10% minder waarde over voor uw maandelijkse pensioeninkomen. Uw maandelijkse pensioeninkomen wordt dus lager. Ook als u heeft gekozen voor ‘bedrag ineens’, ontvangt u dat lagere pensioeninkomen zolang u leeft.

Als u kiest voor ‘bedrag ineens’, ontvangt u een vrij te besteden bedrag. U kunt daarmee bijvoorbeeld (een deel van) uw hypotheek aflossen, een verbouwing betalen, een mooie reis maken of een andere grote aankoop doen. Het voordeel is dat u uw pensioen kunt afstemmen op uw persoonlijke situatie en toekomstwensen. Deze flexibiliteit heeft wel een prijskaartje, want uw levenslange maandelijkse pensioeninkomen wordt navenant lager. Een financieel adviseur kan voor u in kaart brengen of het 'bedrag ineens' bij uw situatie past.

Uw totale pensioen vertegenwoordigt een bepaalde waarde. Deze is afhankelijk van de gemiddelde levensverwachting, de rentestand en van uw leeftijd op het moment dat u de keuze maakt. Om u een idee te geven: stel uw opgebouwde pensioen op jaarbasis is € 10.000 (bruto). Als u op uw 68-ste kiest voor het maximale percentage van 10% voor het ‘bedrag ineens’, dan krijgt u op dat moment een bedrag van € 18.650 (bruto) ineens uitbetaald. Uw levenslange pensioen wordt hierdoor 10% lager: € 9.000 bruto per jaar.

Wilt u dit zelf ook berekenen? In de Pensioenplanner kunt u berekenen hoe hoog uw verwachte pensioen is op de door u gewenste pensioenleeftijd. In het Pensioenreglement vindt u in bijlage 1 de tabel 'afkoop ouderdomspensioen' (pagina 60). Daar kunt u voor uw gewenste pensioenleeftijd zien hoeveel u kunt krijgen als ‘bedrag ineens’ per € 1.000 ouderdomspensioen. Vermenigvuldig het afkoopbedrag met uw opgebouwde pensioen gedeeld door €1.000. Van dit bedrag kunt u maximaal 10% ineens ontvangen met de keuzemogelijkheid 'bedrag ineens'.

Bijvoorbeeld: u wilt uw pensioen laten ingaan op 65 jaar en heeft in de Pensioenplanner berekend dat uw verwachte ouderdomspensioen op die leeftijd € 15.000 bedraagt. Als u kiest voor een ‘bedrag ineens’ van 10%, dan leest u in de tabel af hoeveel u kunt krijgen voor € 1.500 (10% van € 15.000) ouderdomspensioen. In de tabel staat dat u per € 1.000 een bedrag van € 18.230 kunt krijgen, dus voor € 1.500 krijgt u 1,5 x € 18.230 = € 27.345. Zo kunt u ook andere percentages tussen 1% en 10% berekenen.

Nee, het nabestaandenpensioen voor uw partner wijzigt niet door ‘bedrag ineens’. We vragen u altijd eerst om te kiezen of u uw nabestaandenpensioen wilt behouden of wilt inruilen voor een hoger ouderdomspensioen. Kiest u voor dat laatste? Dan wordt als gevolg van die keuze uw nabestaandenpensioen lager of het vervalt. Het ‘bedrag ineens’ wordt in dat geval berekend over het hogere ouderdomspensioen.

In het nieuwe pensioenstelsel krijgt u een persoonlijk pensioenpotje waaruit uw pensioen wordt betaald. Als u nu kiest voor ‘bedrag ineens’, dan wordt uw levenslange ouderdomspensioen lager en daarmee ook de waarde van het pensioenpotje dat u straks krijgt. Heeft Philips Pensioenfonds op het moment van overgang naar het nieuwe pensioenstelsel een dekkingsgraad die hoger is dan 100%? Dan is er sprake van een buffer. Die buffer komt dan waarschijnlijk voor een groot deel toe aan de persoonlijke pensioenpotjes van deelnemers. Als u heeft gekozen voor ‘bedrag ineens’, is het aandeel dat u krijgt uit de buffer lager. U heeft immers een lager pensioen dan wanneer u niet voor ‘bedrag ineens’ gekozen had.