Investment policy: a quick introduction

Philips Pensioenfonds intends to offer a retirement income that retains its purchasing power over time. This ensures that your retirement income enables you to buy the same amount of goods and services as you are able to buy now. We call this a real retirement income, which is our ambition. To realise this ambition, we aim to increase your retirement income by increases in prices (for retired and non-contributory policyholders) and wage increases (for active members). This is called ‘indexation’. For the Pension Fund to be able to index your pension in the long term, our investments need to generate a sufficient return.

Responsible investment

Do you want to know more about taking the environment, social aspects and good corporate governance into account when choosing investments?

Go to Responsible investmentStrategic allocation

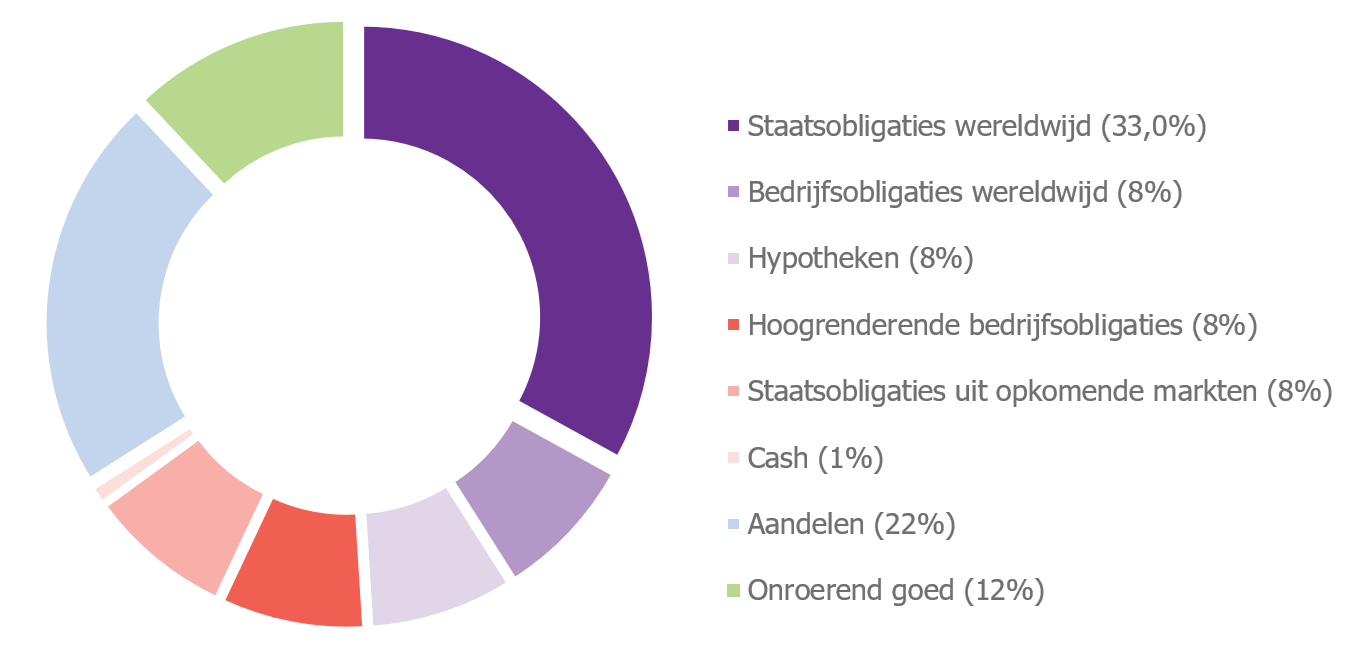

The investment policy is based on an investment portfolio that distinguishes between fixed-income and return assets. The distribution at any point in time is aimed at having a good chance of achieving our ambition in the long term, a pension that is stable in value for retired members and non-contributory policyholders and a welfare pension for active members, without the risks becoming too great.

The fixed-income securities largely consist of relatively 'safe' investments, which significantly secure part of the future expected pension benefits. Think in particular of government bonds with a spread within and outside Europe. It also invests in slightly riskier fixed income securities, such as corporate bonds and emerging market bonds. The higher risk is compensated by a higher return expectation.

The investments with more risks are classified as real assets. The aim of these investments is to achieve greater returns. Think of investments in shares and real estate.

Due to a new pension system that will come into effect in the Netherlands within a few years, the Board of Philips Pensioenfonds has considered what this change means for the Fund's policy. We are dealing with a new reality in the short term. The Fund's policy is normally long-term. However, due to the upcoming system change, there is reason to deviate from our long-term policy on a number of points. The aim of this is to give our participants a good start in the new pension system.

At the end of 2021, the Board decided, among other things, to reduce the risk profile of our investments during the transition to a new scheme, for which the allocation to equities was reduced by 7.5 percentage points in favor of government bonds and cash. In addition, the strategic interest rate hedge has been adjusted from a dynamic hedge to a higher and fixed interest rate hedge of currently 45% of the real pension liabilities. In the fourth quarter of 2022, the distribution of the investment portfolio changed slightly compared to the previous quarter because part of the Fund's assets were held outside the investment portfolio in cash as a buffer.

Therefore, the distribution of the investment portfolio is temporarely as follows: 66.0% of the assets are invested in fixed-income securities and 34.0% of the assets are invested in commercial securities. The chart below shows more details. Fixed-income asset classes are shown in purple and orange, while return assets are presented in blue and green.

Would you like to know more about the adjustments to the investment policy and the other decisions taken by the Board at the end of 2021 with a view to the arrival of the new pension system? Click here and read the news item.

Overview of the Fund's largest investments (in Dutch)

Return on the portfolio

To find out more about the total return on the investments, click here

Related information

Is the information below perhaps also interesting for you?

Why does Philips Pensioenfonds make investments?

For the first part of the series about our investments the question 'Why does Philips Pensioenfonds make investments?' is answered.

Part 1

In which types of investments does Philips Pensioenfonds invest?

For the second part of the series about our investments the question 'In which types of investments does Philips Pensioenfonds invest?' is answered.

Part 2

How does Philips Pensioenfonds determine its investment mix?

For the third and last part of the series about our investments the question 'How does Philips Pensioenfonds determine its investment mix?' is answered.

Part 3